The 50/30/20 rule is not magic but needs discipline. Suppose your salary disappears faster than a bucket of popcorn in a Bollywood movie. It’s time for a smart kind of chat about budgeting. Managing money is not always easy in India. Rent, Swiggy, EMIs, and random impulse shopping on increasing it very fast. But what if there was a simple way to plan your expenses without complicated spreadsheets or feeling guilty every time you buy a chai?

Here is a rule that can help you solve this problem forever. This is the 50/30/20 rule, which is a super simple, no-jargon budgeting method that actually works. And yes, it works even if you’re living in Delhi with a 2BHK rent or hustling in a Tier-2 city on a modest salary.

Let’s break it down the desi way.

Table of Contents

Let’s Understand the 50/30/20 Rule in Detail

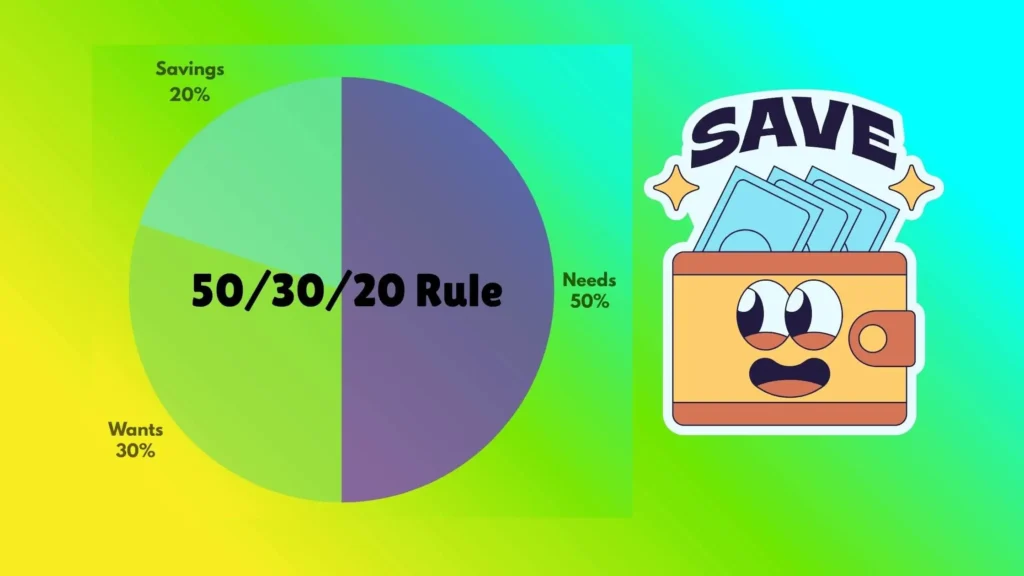

This 50/30/20 rule is a personal finance habit that divides your income into three parts.

- 50% for Needs (essentials like rent, groceries, bills)

- 30% for Wants (shopping, movies, food delivery)

- 20% for Savings & Debt Repayment (investments, loan EMIs, emergency fund)

Think of it as a financial thali. You get your roti (essentials), your sabzi (wants), and your chutney (savings) all in balanced portions.

Applying the 50/30/20 Rule For Indian People

If a person’s monthly salary is ₹50,000. Here’s how the 50/30/20 split works in India:

| Category | Amount (₹) | Example Expenses |

| Needs (50%) | ₹25,000 | Rent, groceries, mobile & internet bills, transport |

| Wants (30%) | ₹15,000 | Netflix, Swiggy, weekend trips, shopping |

| Savings (20%) | ₹10,000 | SIPs, PPF, emergency fund, paying off credit cards |

What counts as a “Need” vs. a “Want”?

I know you also want to know these two terms. This is essential to know if you really want to get rid of this problem, which is overspending. This is where most of us get confused.

Needs ( Basic survival stuff):

- Rent or home loan EMI

- Electricity & water bills

- Milk, vegetables, and monthly groceries

- School/college fees

- Transport (Metro card, petrol, Ola for emergencies)

Wants ( Nice-to-have stuff):

- Netflix, Prime Video, Hotstar subscriptions

- Weekend pizza from Dominos

- Myntra shopping hauls

- Zomato Gold or Tinder Premium

Savings/Repayments:

- SIPs or mutual fund investments

- PPF/EPF contributions

- Emergency fund (at least ₹1–2 lakh target)

- Paying off credit card or personal loan EMIs

For example, Rahul is a 28-year-old IT professional in Pune earning ₹60,000/month after tax.

Here’s how Rahul manages his budget:

- ₹30,000 → Rent (₹15k), groceries (₹6k), bills & commute (₹9k)

- ₹18,000 → Gym membership, OTT, travel with friends, eating out

- ₹12,000 → ₹6k SIP, ₹4k loan EMI, ₹2k emergency fund

He follows the 50/30/20 rule almost perfectly. And he still manages a Goa trip once a year without any financial burden.

Why the 50/30/20 Rule Works Especially in India

- Easy to remember (No need to become a CA)

- No guilt — It allows for fun spending too

- Flexibility — Works whether you earn ₹25K or ₹2L/month

- Promotes savings — Without forcing you to live like a monk

In Indian households where budgeting often means “just try to spend less,” this rule gives a clear framework.

What if My Income Is Too Low?

Many people living in India have the same problem. It is very difficult for everyone to follow the 50/30/20 rule perfectly for every individual.

So, you can start with 60/20/20, or if required, you can follow 70/10/20.

The goal is to build the habit of saving, not to hit exact numbers.

Tips to Make the 50/30/20 Rule Work in Real Life

1. Use UPI Apps & Trackers

Apps like Walnut, ET Money, or even Google Sheets can help categorize your spending. This will help you track your monthly budget using these budgeting apps.

2. Automate Your Savings

Set auto-debit for your SIP or RD right after salary credit. So that all the necessary expenses are done on time without delay.

3. Set Fun Limits

You have to set a limit on your fun activities expenses. Wants are not a bad habit, but you just have to plan for them! ₹1,500/month for Swiggy is okay. ₹6,000 is a food addiction.

4. Talk About Money at Home

It is very important to discuss budgeting with family or a partner. We need to educate everyone around us. So that we can develop a habit.

Summary

The 50/30/20 rule is a simple and flexible way to manage your money in India. It helps your income be smartly divided into needs, wants, and savings. It is very Easy to follow, and any beginner can easily start using it. It is perfect for anyone trying to build better financial habits without complicated planning.

It’s neither perfect nor rigid. But it gives you a solid starting point to control your money instead of wondering where it vanished every month. It’s easy, effective, and works for all income levels in India. Real people are using it and making their lives better. Even a little saving is better than none. Start now, do not wait until Diwali. Start with one salary cycle. Try to track, adjust, and improve over time.